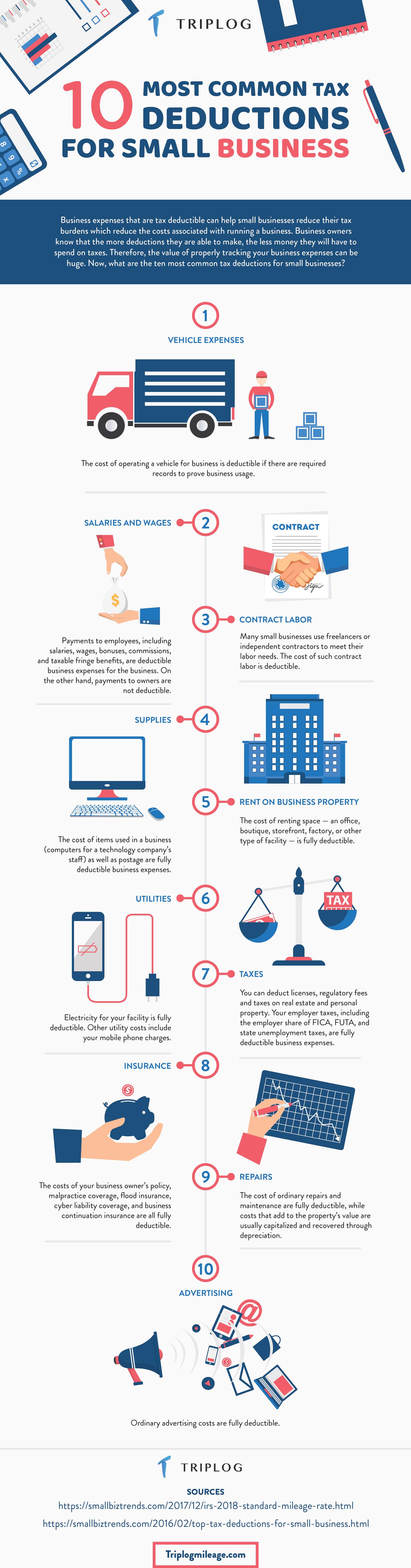

Businesses have to pay tax: that’s the law. But did you know that there are all sorts of ways that you can cut your tax bill? As the following infographic makes clear, there are several ways of obtaining tax deductions, helping you to boost your firm’s profitability and redirect funds to the things you want.

Companies incur what are called “expenses.” Expenses are just things that your firm spends money on that is necessary for carrying out business. For instance, if you operate a fleet of vans as part of your business, the fuel and maintenance on those vehicles count as an expense: a necessary cost for rendering services to customers. Likewise, the cost of renting an office counts as an expense. You need premises to organize colleagues and carry out your operations.

The problem for many entrepreneurs and CEOs is that they don’t know about all of the opportunities to reduce tax bills through expenses. The more that you can claim on expenses, there is less taxable income left over, so it’s worth doing.

The trick to ensuring that you get tax deductions is keeping good records. You’ll want to keep receipts so that you can prove to the taxman that you did indeed incur expenses.

Take a look at the following infographic. It shows all of the common ways in which companies can get tax deductions. Remember, if you don’t claim for expenses, you could be paying too much tax because the IRS may believe that your profits are higher than they are.

Infographic created by TripLog

This is a contributed post.

Discover How We Help Startups Scale To 100,000 Users And Beyond.

Enter your info below, and we’ll send you a complimentary white paper that shows you exactly what you need to do to scale your startup.